california mileage tax bill

Jerry Brown has received legislation that would make California the third West Coast state to test replacing state fuel tax with a vehicle-miles-traveled fee. Personal Vehicle approved businesstravel expense 0585.

Sandag Plan Board Of Directors Approves 160 Billion Transportation Plan Cuts Out Mileage Tax

Personal Vehicle approved businesstravel expense 0585.

. DMV reminds our customers to create or update your MyDMV account with your current mailing address and email address to stay informed about DMV services and to make sure important information from the DMV is sent to the. Instead of paying at the pump when purchasing fuel a mileage tax system determines a drivers vehicle. California will be losing another tax payer between all taxes to the statecounty I pay about 12kyear.

Private Aircraft per statute mile. California Expands Road Mileage Tax Pilot Program. A new 100 annual fee will be imposed on all zero-emissions vehicles.

The San Diego Association of Governments board of directors passed the 2021 Regional Transportation Plan without the controversial road mileage tax Friday but questions remain as to how the. California also pumps out the highest state gas tax rate of 6698 cents per gallon followed by Illinois 5956 cpg Pennsylvania 587 cpg. Road Charge is an alternative funding mechanism that allows drivers to support road and highway maintenance based on how many miles they drive instead of how many gallons of gas they use.

The proposed tax is part of a 163 billion plan to improve transportation in San Diego County. Personal Vehicle state-approved relocation 018. Gavin Newsom signed into law a bill that expands a pilot program that tests whether a tax on miles driven might work better to fund road construction and repair than a tax on fuel purchases.

Since 2015 the program allows the state to study a road user charge based on vehicle miles traveled as an alternative to fuel taxes. December 11 2017 633 PM CBS San Francisco. California mileage tax bill Tuesday June 7 2022 Edit.

Unless otherwise stated in the applicable MOU the personal aircraft mileage reimbursement rate is 1515 per statute mile. Replacing Californias gas tax. A new bill going through Sacramento would tax drivers for every mile they are on the road.

Among other things SANDAG hopes to make public transit free for everyone. Applications subject to use tax received in the mail. The state gasoline tax of 529 cents per gallon could be replaced with a.

Reimbursement Rate per Mile. California has announced its intention to overhaul its gas tax system. 4010 Calculating Use Tax Amount.

SAN FRANCISCO KPIX 5 -- California is moving closer to charging drivers for every mile they drive. I have been resisting against all common sense leaving California completely. I dont want to sell my home but it is time.

Those paying mileage tax receive credit on their bills for fuel taxes they pay at gas stations. The state says it needs more money for road. The proposal includes a 200-mile regional rail network that would cost 43 billion and run at no cost to riders.

In California Jet Fuel is subject to a. California Department of Motor Vehicles DMV - apply for a REAL ID register a vehicle renew a drivers license and more. For example say you inherit a 50000 IRA which because it was included in your mothers taxable estate boosted the estate tax bill by 20500.

California relies on gas tax and other fuel tax revenues to fund its roadway maintenance and repairs. Have found Florida to be much. Each application subject to use tax must show the purchase price on the back of the Certificate of Title or include a bill of sale.

A CDTFA 1138 is required for commercial vehicles as specified under the Use Fuel Tax Law showing the amount of use tax due. The new fees and increased taxes will amount to 524 billion over 10 years according to an article in the Sacramento Bee. The money so collected is used for the repair and maintenance of roads and highways in the state.

The Cochran case provides guidance on how to calculate a reasonable reimbursement for the mandatory use of personal devices such as cell phones. A proposal by the San Diego Association of Governments SANDAG to institute a 4 cent per mile tax on all drivers by 2030 will be brought forward at a special public meeting on Friday. Today this mileage tax.

This means that they levy a tax on every gallon of fuel sold. The board is expected to vote on the proposal Dec. Californias Proposed Mileage Tax.

The bill would require that participants in the program be charged a mileage-based fee as specified and receive a credit or a refund for fuel taxes or electric vehicle fees as specified. But opponents are concerned the legislation is laying the groundwork for a permanent mileage tax. Traditionally states have been levying a gas tax.

The state gasoline tax of 529 cents per gallon could be replaced with a. Tax code changes and California business reimbursements. California Expands Road Mileage Tax Pilot Program Traffic flows past construction work on eastbound Highway 50 in Sacramento California.

Gavin Newsom has signed into law a bill to extend the states mileage tax pilot program. This means that 30 to 40 of most drivers allowance goes to income and payroll taxes. Today this mileage tax.

Thus a 600month payment might be reduced to 360. Governmental leaders across California as well as in other states such as Utah and Oregon have been looking at how to replace the gas tax in the coming decades due to gas. Just like you pay your gas and electric bills based on how much of these utilities you use a road charge - also called a.

A new bill going through Sacramento would tax drivers for every mile they are on the road. A standard car allowance is taxable unless the company uses a business substantiation procedure such as mileage tracking or FAVR more on this below. 4030 Refund of Use Tax.

The California legislature passed a bill extending a road usage charge pilot program.

We Ll Need To Replace The Gas Tax In Transition To Zevs Calmatters

Vehicle Mileage Tax Could Be On The Table In Infrastructure Talks Buttigieg Says

Thoughts At A Workshop On Replacing Ca S Gas Tax With A Mileage Fee Streetsblog Los Angeles

Adjusted Annual Property Tax Bill Los Angeles County Property Tax Portal

Sandag S Proposed Road Charge Would Piggyback On California S Plans For A Per Mile Driver Fee The San Diego Union Tribune

Sales And Use Tax Regulations Article 11

Sales And Use Tax Regulations Article 11

County City Leaders Push Back Against Proposed Mileage Tax

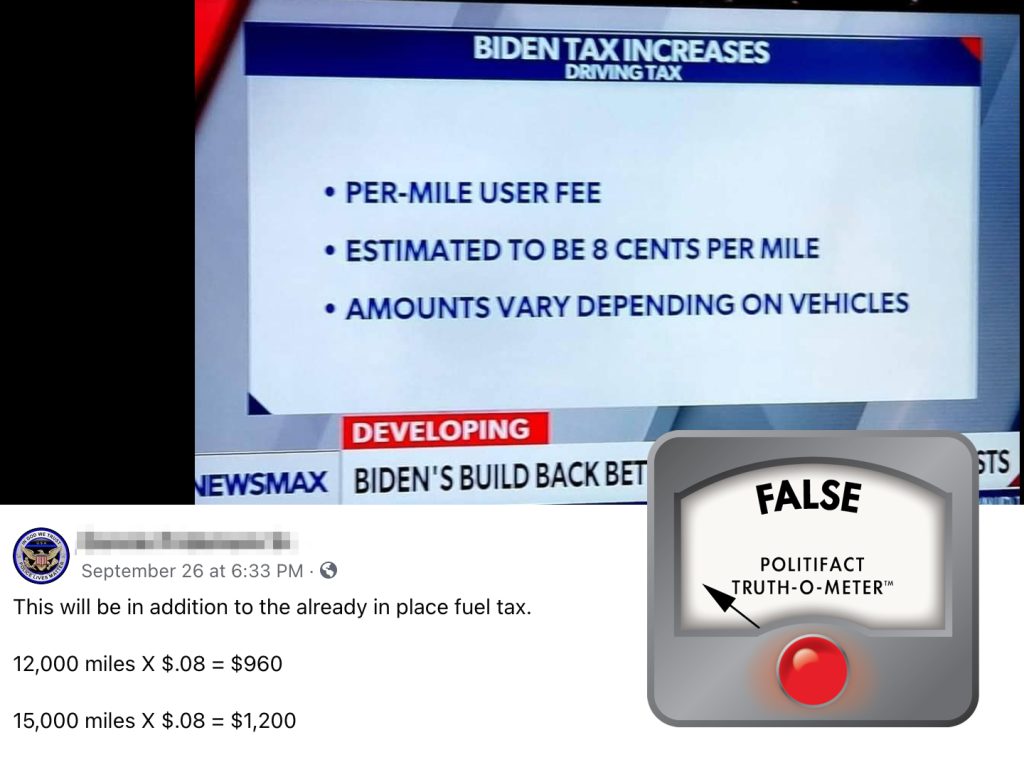

Mileage Tax Study Not Actual Mileage Tax Proposed In Infrastructure Bill Ap Berkshireeagle Com

California S Road Usage Charge Pilot Program Stirs Controversy The Coast News Group

Paying By The Mile For California Roads Infrastructure Capitol Weekly Capitol Weekly Capitol Weekly The Newspaper Of California State Government And Politics

Vehicle Mileage Tax Could Be On The Table In Infrastructure Talks Buttigieg Says

What San Diegans Should Know About The 160b Plan For Transit And Road Charges Approved On Friday The San Diego Union Tribune

Vehicle Miles Traveled Tax Proposed

San Diego Driving Tax Locals Torn Over Per Mile Road Usage Tax Discussed By Sandag

What Are The Mileage Deduction Rules H R Block

Secured Property Taxes Treasurer Tax Collector

Politifact Biden Infrastructure Plan Wouldn T Establish A Per Mile Driving Tax Nbc 6 South Florida

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos